C

reating a forex risk management plan may seem intimidating at first, but it’s essential for long-term success in forex trading. By following a few key forex risk management strategies, you can craft a plan that aligns with your trading style and helps you manage risks effectively. Whether you’re a beginner or an experienced trader, a solid risk management plan is crucial to maintaining control over your trades and protecting your capital.

- Assess Your Risk Tolerance

Each trader has a unique level of comfort when it comes to risk. Forex risk management experts often recommend risking between 1% and 5% of your account balance on each trade, but ultimately, you should choose a risk level that feels right for you.

At the beginning of your trading journey, it’s wise to keep your risk percentage on the lower end of the scale. As you gain experience and confidence with your simple trading strategy, you may feel tempted to increase your risk, but proceed with caution.

The goal of trading isn’t just to make a profit—it’s also to preserve enough capital for your next trade. For example, if you risk 10% of your account on each trade, losing 10 consecutive trades could wipe out your account. On the other hand, if you risk only 2% per trade, you would have to lose 50 trades in a row to deplete your account.

- Properly Size Your Positions

Once you’ve determined how much risk you’re willing to take on each trade, the next step is to size your positions correctly.

For example, if you’re willing to risk $100 on a trade, buying 100 CFDs (Contracts for Difference) of a stock could expose you to more risk than you’re comfortable with. If the price moves against you by a single point, you could hit your risk limit quickly.

To ensure you’re risking only what you intend, understand the contract sizes for the assets you’re trading. In forex, a standard lot represents 100,000 units of a currency pair, and on EUR/USD, this translates to $10 per pip. A mini lot represents 10,000 units.

For instance, if you want to risk $15 per pip on EUR/USD, you would need to trade mini lots rather than standard lots to align your position size with your risk tolerance.

Having the flexibility to adjust your position size based on your forex risk management preferences is crucial for effective risk management.

- Set Your Trading Schedule

Forex markets are open 24/5, meaning you have ample opportunity to trade. However, it’s important to decide how much time you want to dedicate to trading each day—and when to do so.

Being clear on your trading hours will help you get into the right mindset for making decisions. For example, trading at 3 AM might not be the best approach if you’re not fully alert and focused.

In addition, exit orders and alerts can help you manage risk when you’re not actively monitoring the markets. For instance, setting stop-loss orders or profit targets ensures your positions are managed even when you’re away from the screen.

- Be Aware of Weekend Gaps

Forex markets close on Friday afternoon (Eastern Time) and reopen on Sunday evening. During this time, prices may shift significantly, but the charts will remain static until the markets open again.

This phenomenon, known as “weekend gaps,” can cause markets to open at prices far from where they closed on Friday, potentially bypassing your stop-loss levels. To mitigate this risk, you have two options:

- Close your position before the market closes on Friday.

- Set a guaranteed stop loss, which will protect you from gaps by ensuring your stop-loss level is honoured even if prices move suddenly.

Being aware of weekend gaps and planning your trades accordingly can help protect your capital from unexpected market moves.

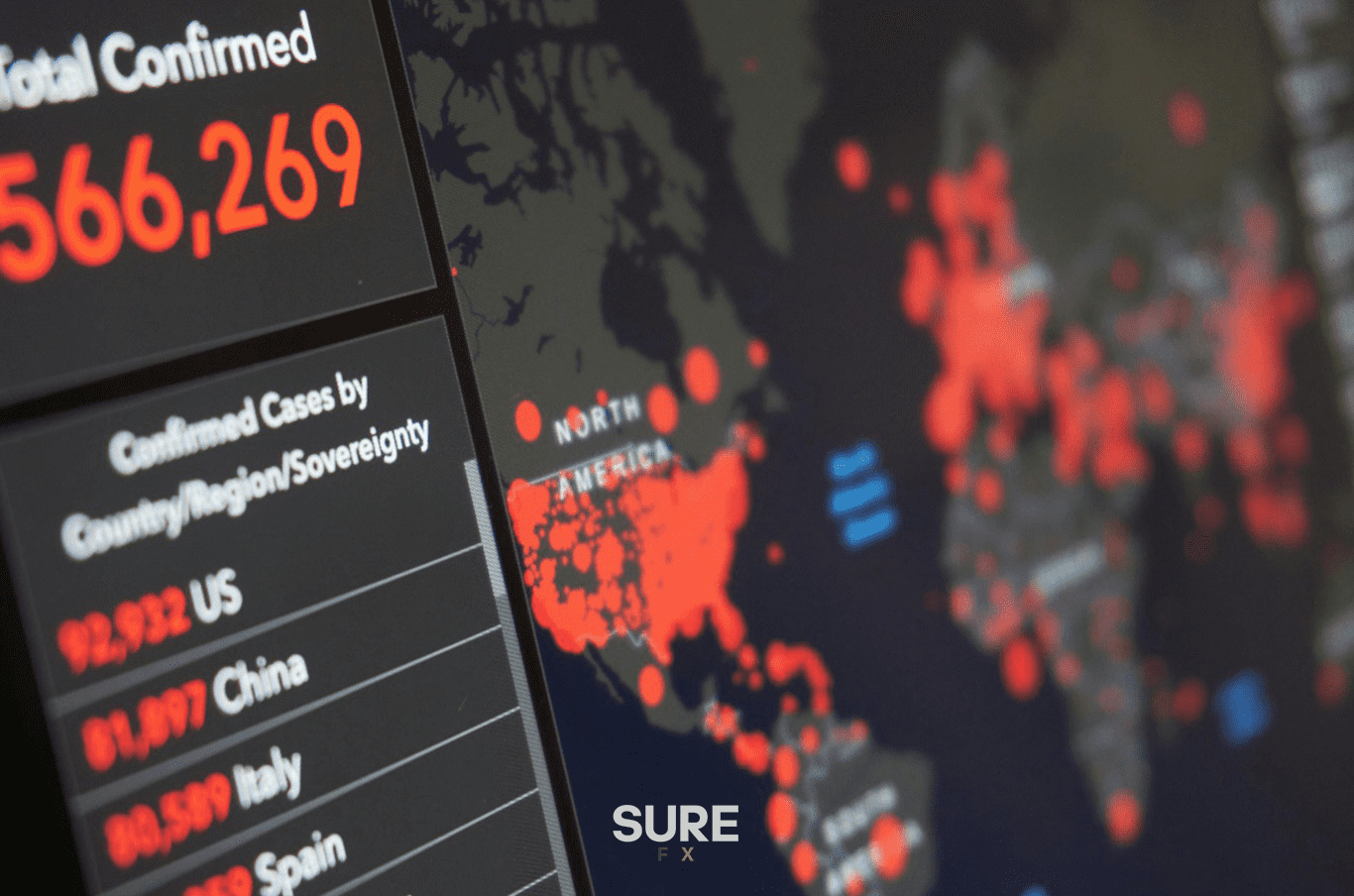

- Monitor Forex News

Forex news events can significantly impact currency markets. Major news, such as central bank announcements, employment data, and inflation reports, often trigger sharp price movements. These events can create volatility, cause gaps in the market, and lead to unpredictable price swings.

Just as weekend gaps can bypass your stop-loss or profit targets, similar gaps can occur immediately after a major news release. If you’re trading around significant news events, it’s essential to have a risk management strategy in place to handle the increased volatility.

If you’re looking to trade the forex news specifically, your forex risk management strategies should involve setting appropriate stop losses and using smaller position sizes to limit potential losses. Trading after volatile news releases requires extra caution, especially if you’re following a simple trading strategy.

- Trade Within Your Means

The most basic rule of trading is to never risk more than you can afford to lose. Forex risk management strategies stress the importance of controlling your risk exposure and avoiding the temptation to over-leverage your account.

Forex trading can be highly volatile, and the market dynamics are often difficult to predict. It’s essential to trade intelligently and avoid risking funds that could put your financial security in jeopardy. By focusing on smart, well-considered trades and employing a simple trading strategy, you’ll improve your chances of success while minimizing the risk of significant losses.

In Conclusion:

A solid forex risk management plan is a key element in becoming a successful forex trader. By determining your risk tolerance, sizing your positions appropriately, being aware of market timing, managing your exposure to weekend gaps, monitoring forex news, and trading within your means, you can better control your risk and protect your capital. Remember, the goal isn’t just to make profits—it’s also to safeguard your account for the long-term using forex risk management strategies that fit your individual style.